Comprehensive leasehold reform has been under consideration since late 2017.

In July 2020, the Law Commission released multiple reports, proposing an extensive array of reforms. The only legislation enacted thus far, however, has been the Leasehold Reform (Ground Rent) Act 2022. The 2022 Act restricts the ground rent due under most new long residential leases (and those for retirement homes after April 1, 2023) to a nominal one peppercorn annually (essentially reducing ground rents to nil).

This position of relative stasis is, however, likely to change in 2024. On the 27 November 2023, the Government introduced the Leasehold and Freehold Reform Bill to reform leaseholder rights, and to reduce the premiums payable for statutory lease extension or enfranchisement (freehold purchase).

The following is a brief overview of the main reform proposals, as of December 2023.

Summary of the Leasehold and Freehold Reform Bill's Provisions:

- Statutory Lease Extension Term: The Bill will provide for extended lease terms post statutory lease extension of 990 years in addition to the existing term for flats (up from 90 years currently) and a further 50 years for houses.

- Capping of Ground Rent: Under the current draft of the Bill, ground rent due under existing leases will be capped at 0.1% property freehold value for the purposes of calculating the premium payable for statutory lease extension or enfranchisement (freehold purchase). In cases of onerous doubling or RPI-linked ground rents, this reform will represent a significant value transfer from freeholders to leaseholders. A consultation is currently ongoing (ending 17 January 2024) to determine whether ground rents should be reduced to one peppercorn (£0.01 per annum if collected) or capped at absolute financial values.

- A New Right to Reduce Ground Rent Under Long Leases to Peppercorn: In the event that ground rent under existing leases is not reduced to one peppercorn, the Bill will provide a new, simplified right - applying to leases with terms of greater than 150 years remaining – to reduce the ground rent to one peppercorn on payment of a premium.

- Abolition of 'Marriage Value': Once a lease has less than 80 years remaining, current legislation stipulates that the increase in the value of the property caused by lease extension or enfranchisement must be shared 50:50 with the current freehold owner. This additional charge is known as ‘marriage value’, and can add substantially to the cost of statutory lease extension or enfranchisement. The Bill will abolish marriage value. Hope value - payable in the hope of future marriage value income from flats which do not participate in collective enfranchisement - will also be abolished. This reform represents a significant value transfer from freeholders to leaseholders and may hence be subject to legal challenge.

- Fixing of Rates: The deferment and capitalisation rates used for calculation of lease extension and enfranchisement premiums will be fixed by secondary regulations - to be reviewed by the Secretary of State every ten years. This could either increase or decrease the premiums currently payable depending on the rates selected.

- Immediate Eligibility for New Leaseholders: New leaseholders will no longer need to wait two years to benefit from their legal rights - allowing immediate access to statutory lease extension or (in the case of leasehold houses) enfranchisement.

- Raised Non-Residential Limit for Right to Manage or Enfranchisement: Currently a mixed-use building must have no more than 25% commercial floor space in order to qualify for the collective rights of enfranchisement or Right to Manage (the right of flat leaseholders to take over management of their building).The Bill will increase this commercial floor area limit to 50%. This will extend leaseholder rights to many developments specifically designed and developed to be excluded from them.

- Streamlined Leasehold Transactions: The Bill intends to set a maximum time-frame and fee for providing leasehold property information (‘LPE1 forms’) during a leasehold transaction.

- Service Charge Transparency: The Bill will mandate standardised, clear reporting of service charges to leaseholders. Landlords must issue service charge demands to tenants in a prescribed form - to be detailed in subsequent regulations. Failure to comply with these requirements will render any service charge demand invalid. Annual service charge reports will be required, and where four or more residences incur variable service charges, these annual reports must include accountant-certified statements of accounts. Again, precise guidelines will be outlined in separate regulations. Tenants will also have a right to request service charge information from a landlord.

- Transparent Insurance Fees: The Bill will replace building insurance commissions with transparent administration fees, preventing excessive, hidden charges for leaseholders. Landlords will not be able to charge the costs of arranging insurance to the tenants and will be under a duty to provide specified insurance information.

- Administration Charges: Landlords will be required to disclose a schedule of administration charges. Landlords will only be able to collect administration charges from tenants if these charges are listed in the published schedule. The specifics will be determined by subsequent regulations.

- Extended Access to Redress Schemes for Leaseholders: The Bill will require freeholders managing properties to join redress schemes, offering leaseholders recourse for poor practices.

- Legal Cost Protection for Leaseholders: The Bill will remove the presumption that leaseholders must pay freeholders' legal costs when challenging poor practice (such as service charge abuse). Litigation costs will not be recoverable via the service charge unless a landlord makes a successful application to the Court or Tribunal for an order to the contrary. In addition, leaseholders will no longer be responsible for the freeholder's non-litigation costs of lease extension and enfranchisement (legal and surveyor's fees).

- Redress Rights for Freehold Homeowners: The Bill will extend leaseholder-like redress rights to freehold homeowners on private and mixed tenure estates - allowing them to challenge estate charges. These charges may currently be opaque and excessive, with little recourse for challenge – such developments sometimes being referred to as ‘fleecehold’ estates. Going forward leaseholders will only be liable for estate management charges incurred by the manager of the estate (typically the freeholder). Expenses must be reasonably incurred, and for works of a reasonable standard.

- Strengthening of the Building Safety Act 2022: The Bill will strengthen the Building Safety Act 2022 to ensure that freeholders and developers fund building remediation as intended.

- Leasehold House Sale Ban: The Bill will prohibit the sale of new leasehold houses, except in exceptional cases, ensuring most new houses in England and Wales are freehold from the start. It should be noted, however, that this measure was accidentally omitted from the original draft of the Bill and will need to be added by amendment.

The Leasehold and Freehold Reform Bill may be subject to substantial amendment during its passage through both houses, and in the event of an early general election, the Bill may be abandoned.

Several of the measures proposed could be construed as interfering with existing legal contracts of good standing, and would represent a significant value transfer from freeholders to leaseholders. In particular, the new valuation methodology is disconnected from market forces and extremely artificial in that it assumes the legal rights of lease extension or enfranchisement will never be sought - precisely at the moment that these rights are exercised.

The Rt Hon Michael Gove has argued that the new valuation methodology complies with Article 1 of the European Convention on Human Rights - which states that individuals are entitled to peaceful enjoyment of property. Deprivation of this right may be permitted in the "general interest", but it is difficult to see how the general interest of freehold owners (including leaseholders who have enfranchised at significant financial cost), and indeed investors and their beneficiaries (such as charities, or pension funds and their members) can be disregarded. The planned legislation may hence additionally be subject to legal challenge by institutional freeholders.

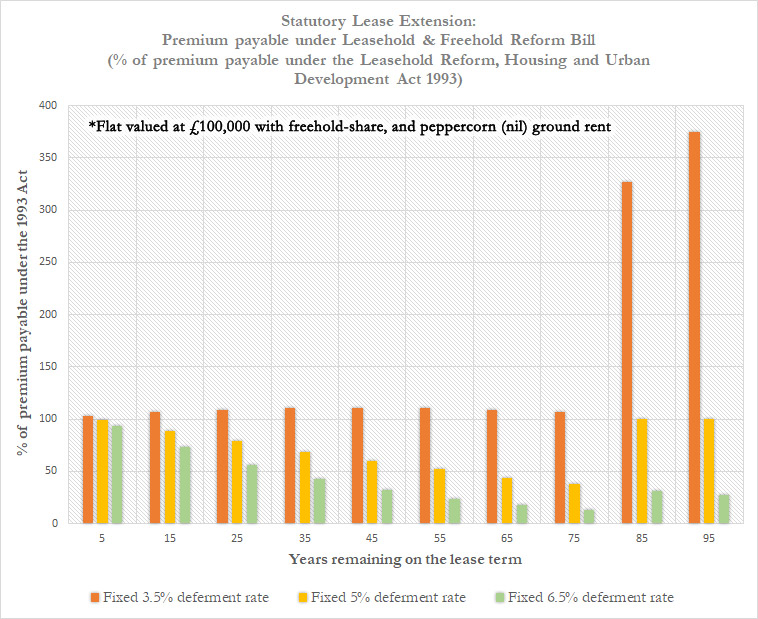

Alternatively, the reforms may somewhat balance one another out. For example, although marriage value may be removed, the Government could decide to fix the rates used in the valuation calculation at a level which is punitive to leaseholders. Reductions to the premium payable for statutory lease extension may hence be less than anticipated. To illustrate this, we provide below a graph indicating the effects of fixing the deferment rate at various levels on the premium payable under the Bill, as a percentage of the premium payable under current legislation (the Leasehold Reform, Housing and Urban Development Act 1993 ("the 1993 Act").

Until the Bill is granted Royal Assent, and the provisions have fully commenced, the legislation that applies to lease extension valuation is the 1993 Act. The Leasehold and Freehold Reform Bill may, however, provide evidence for leaseholders to argue for reduced marriage value (on the basis that there is now a risk that it may be abolished), and reduced capitalised ground rent (on the basis that rents may be capped). These arguments have yet to be tested at the First-tier Tribunal (Property Chamber).

If you are interested in how the proposed changes may affect asset value, our lease extension and freehold valuation reports now include detailed information on the potential implications of reforms.

This article is provided as a general guide only. Although we try to ensure that the information is accurate and up to date, this cannot be guaranteed. The information should not be relied upon or construed as constituting legal advice and Pro-Leagle disclaims any liability in relation to its use.

This article was provided by Pro-Leagle - The Law Firm for Laymen

Written by Corinne Tuplin (LLB, LPC) Solicitor December 2023